Financial advice with heart, clarity, and purpose.

Welcome to The Financial Boutique, where financial advice meets heart. We specialise in holistic, client-centric guidance tailored to individuals and families across Australia. Whether you’re planning for the future, navigating life transitions, or simply seeking clarity, we’re here to walk beside you with thoughtful strategies and genuine care.

Grow with confidence:

your life, your goals,

your financial path.

Our purpose:

Financial advice with heart, clarity, and purpose.

At The Financial Boutique, we believe financial wellbeing is about more than numbers - it’s about feeling confident, supported, and in control of your future. We offer holistic, values-aligned advice that evolves with you, no matter your life stage.

Founded by Katie Young, a financial advisor with a passion for clarity and connection, our boutique practice is built on trust, empathy, and genuine care. We take the time to understand your story, simplify the complex, and guide you with strategies that reflect your goals - not someone else’s template.

Big dreams, small steps - let’s begin together.

At every stage of life, your financial needs evolve—and so should your advice. We offer holistic, values-aligned guidance that empowers you to make confident decisions, protect what matters, and build a legacy that reflects your story.

Whether you’re sowing the seeds of financial wellbeing or preparing to harvest the rewards, we can support you.

Our life stages framework fosters wealth creation no matter what stage of life you’re at.

Planting.

Laying the foundation for financial wellbeing,

We help you plant with purpose, so your financial garden thrives.

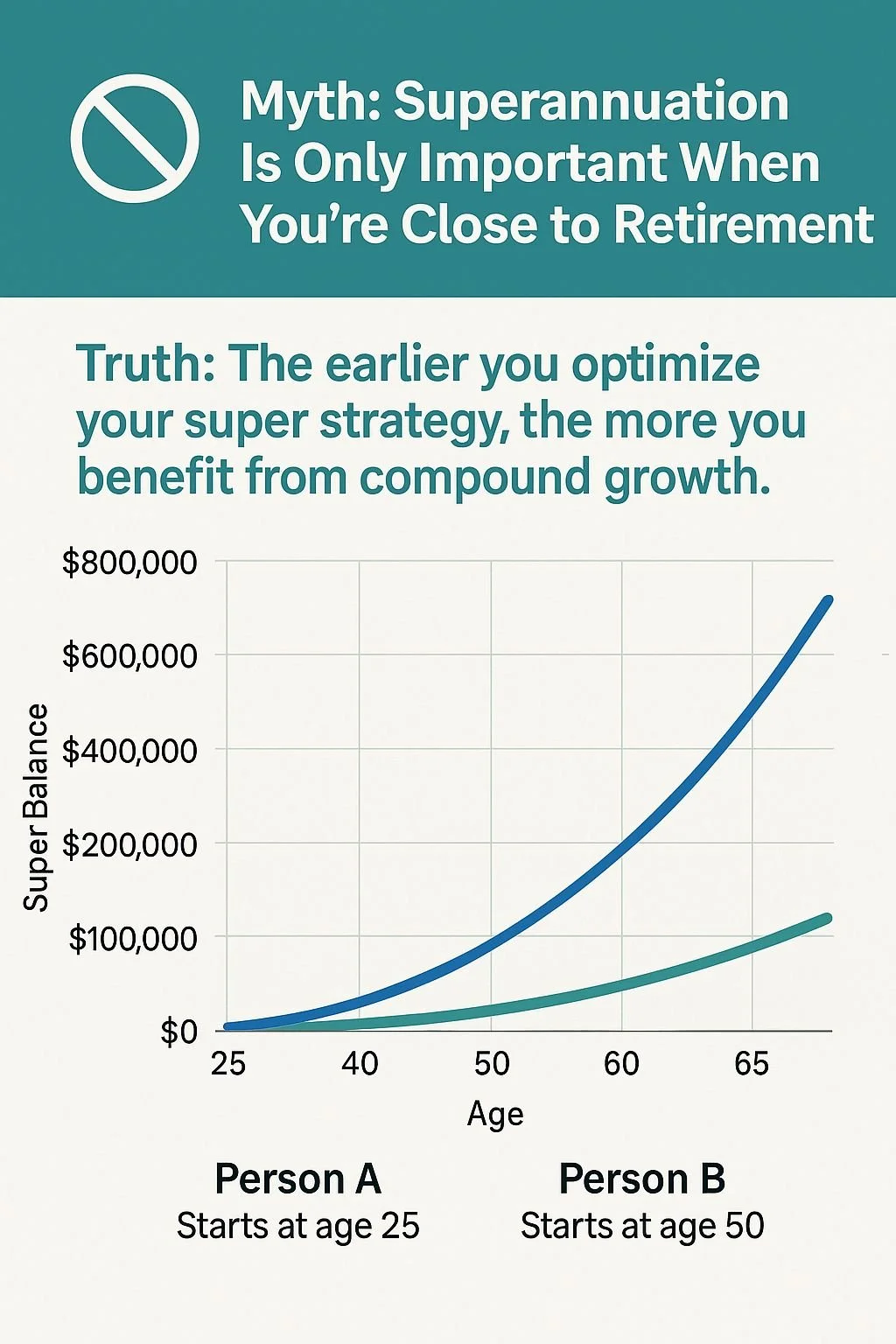

You’re just starting out—saving for your first home, building your career, and beginning to think about your financial future. This stage is all about setting strong roots through smart saving strategies, wealth protection (insurance and risk management), superannuation reviews to ensure your future is on track, and building financial habits that support long-term growth.

Nurturing.

Strengthening your financial position and planning ahead.

This is the season of care, clarity, and strategic growth.

You’ve bought your home, built some equity, and your cashflow is under control. Now you’re ready to look ahead and make intentional decisions about what comes next: equity and investment planning, refining your financial goals, starting to think about family, lifestyle upgrades, or career transitions, and reviewing your super and insurances as needs evolve.

Growing.

Preparing for retirement with confidence.

We help you grow with intention, so your future feels secure and fulfilling.

You’re approaching retirement, and the hard work is paying off. Your debt is nearly repaid, and now it’s time to focus on shaping the next chapter: retirement planning and income strategies, tax-effective wealth management, reviewing superannuation and pension options, and aligning your lifestyle goals with financial realities.

Harvesting.

Enjoying the fruits of your financial journey.

We help you harvest with grace—protecting your lifestyle and your legacy.

You’re in retirement, and now it’s about living well, with peace of mind and purpose. This stage focuses on ensuring the longevity of your funds, maintaining a comfortable lifestyle, legacy planning and estate considerations, and navigating aged care or downsizing decisions.